Following categories of the Employers and Employees are required to obtain EPF registration:

|

S.no. |

Types of organization |

Specific

laws

|

|

1.

|

For

Factories

|

Having

20 or more employees during any time of the year engaged in any industry

|

|

2.

|

Any

other establishment

|

Having

employing 20 or more employees during any time in the previous year

|

|

3.

|

Any

other Establishment

|

Compulsory

registration irrespective of their employees when the Central Government,

after giving two month's notice to the particular establishment. Such

establishments shall have to get themselves registered immediately upon the

receipt of the notice with department.

|

|

4.

|

For

any employee

|

Earning

less than INR 15000/- per month.

|

No, You will not get interest on the withdrawn amount. However, the amount remaining in the EPF account will continue earning interest.

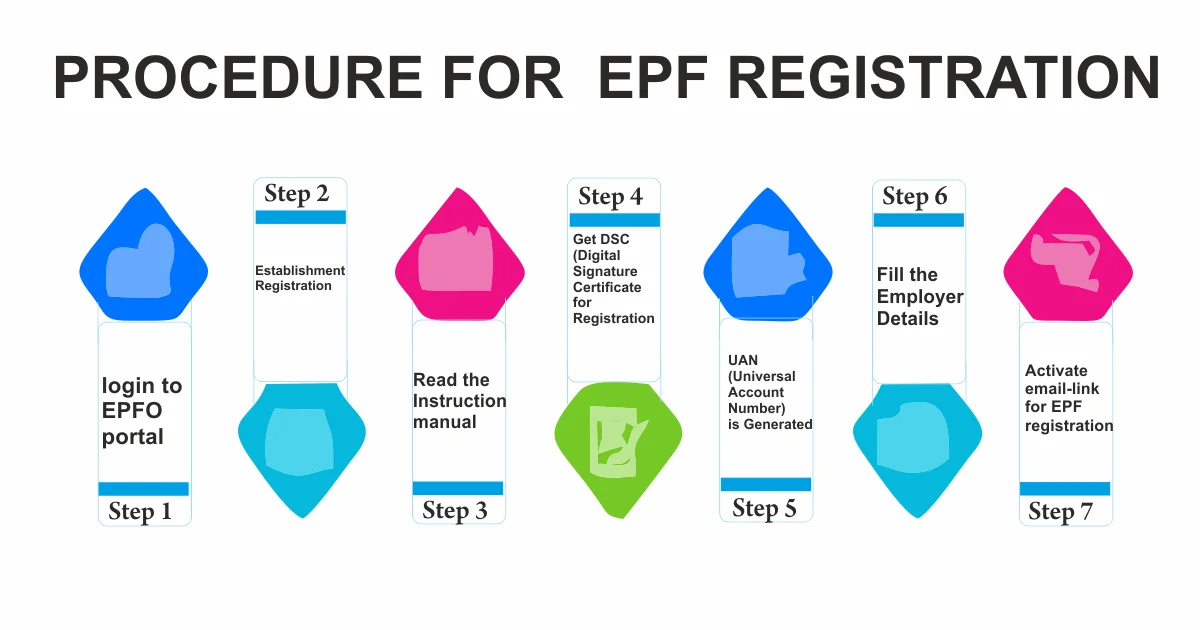

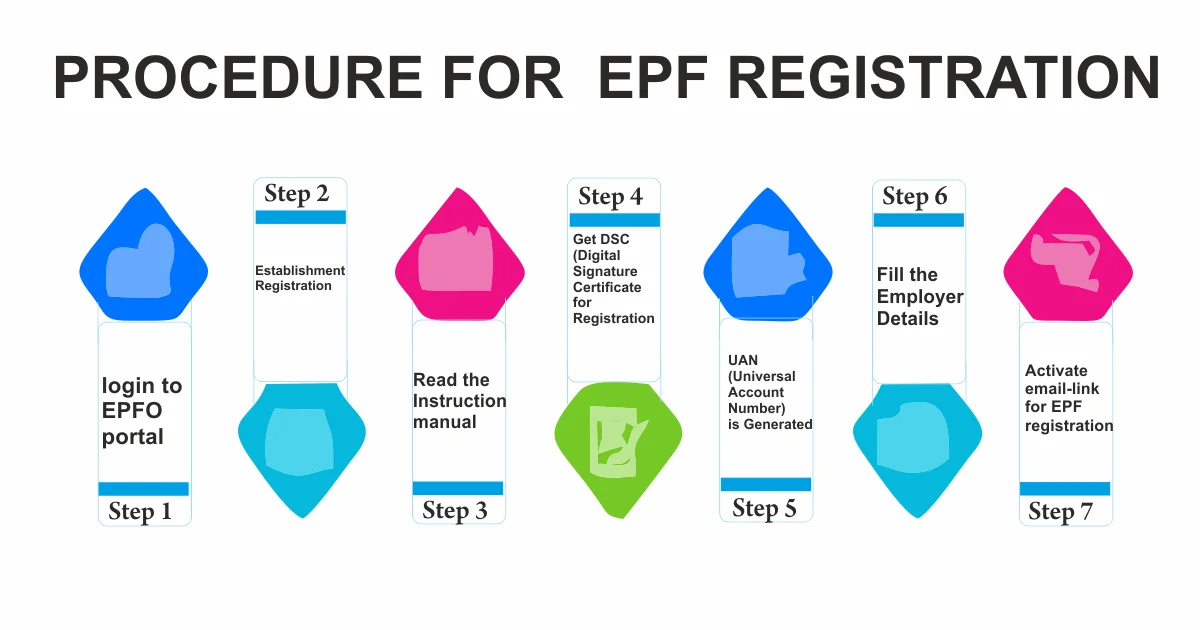

You have to activate UAN by registering at the EPF member portal before you can process claims or withdraw funds online.

It is recommended that you transfer your fund from the old PF account to a new one. If you withdraw the amount before 5 years of service, the withdrawn amount is taxable and should be mentioned under income from other sources while filing ITR.

12% of the employee’s salary goes towards contribution to Provident Fund. Also, Employee State Insurance Corporation(ESIC) is deducted on gross salary which is 1.75% from the employee contribution & 4.75% from the employer contribution.

Thanks for your services. The Vishal and his team is really professional. They make sure that things are delivered in time. The best part about My Companywala is the consultative approach and guiding us on all our business matters.

Great Service in affordable package.. Thanks for explaining the entire process of company registration initially..Now i have very clear idea about company.. paid the amount immediately after the explanation given.. My company is registered and thanks for clearing my doubts after registration as well....service was excellent.

Truly Professionalism .. Never expected that online procedure is so easy.. I have at first idea if going to exceptionally rushed process But I altered up my opinion to give an attempt with Mycompanywala...my Company is enrolled extremely fast....they still in contact with me. Continually illuminating my questions.. Much obliged for all you help

It was decent involvement with My Companywala for convenient work also extraordinary help and guidance to begin my business...Great benefits in opportune way and subsequent meet-ups for return recording to spare my money...Thanks Again

Copyright © 2018 MYCOMPANYWALA all right reserved.