What is RERA?

RERA, full form of which is Real Estate Regulatory Authority, stands for transparency in the real estate industry. It was brought to action to eradicate the existing discrepancies and problems within the sector.

Why is RERA required?

With RERA in place, every builder or developer is required to inform homebuyers of the progress of construction, offer them keys to their property on the due date, and abide by every rule outlined by RERA, to ensure accountability.

Benefits of RERA

- Authencity: RERA aims to reduce project delays and mis-selling. In order to do so, authorities have made it mandatory for all builders/developers to carry out RERA registration before they start a project.

- Area: RERA has been sub-divided into smaller regulatory bodies, each of which look after the real estate development in a single state or union territory in India.

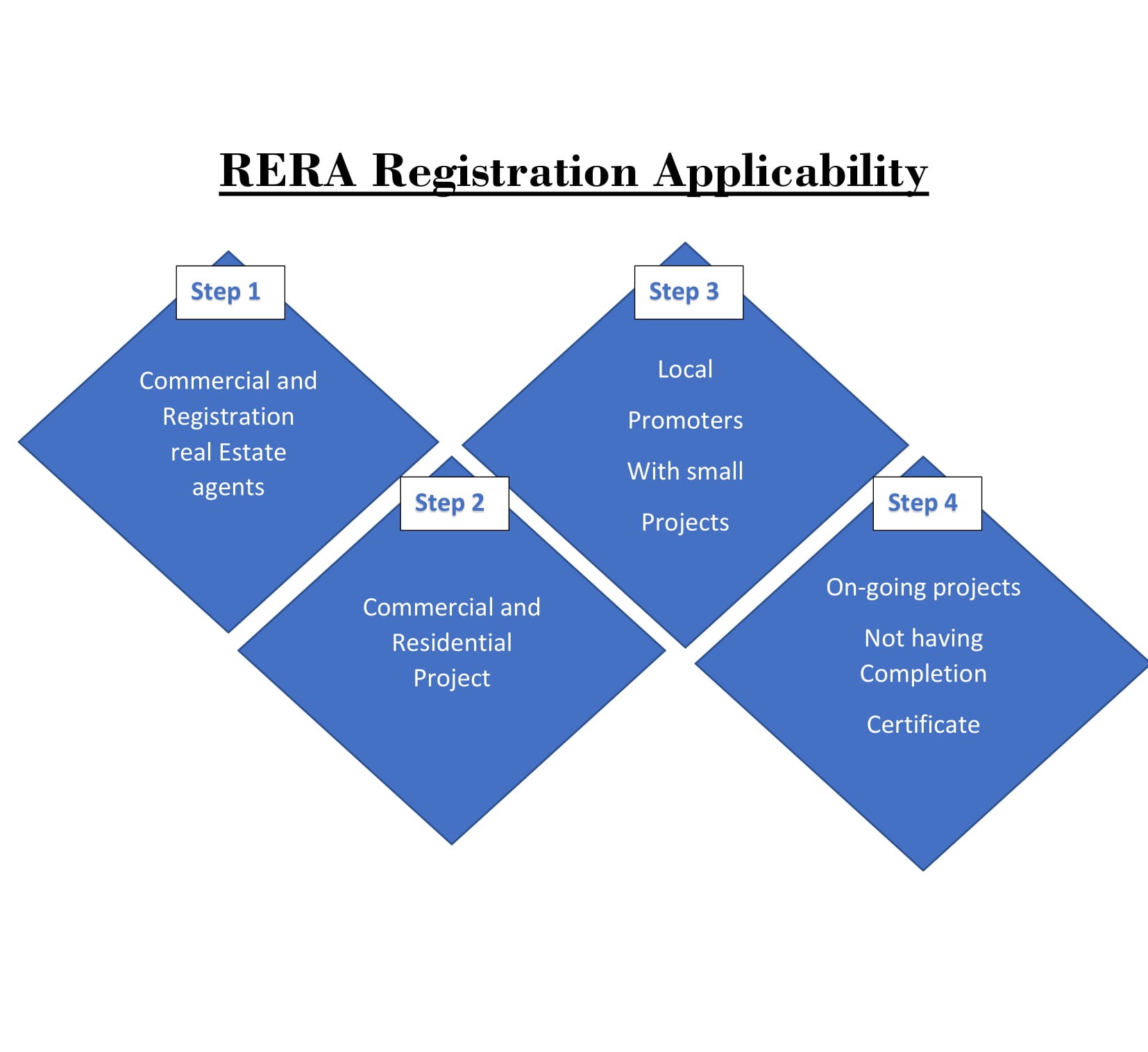

- Applcablity: RERA rules are applicable to both residential and commercial properties.

- Interest: The standardisation brought about by RERA aims to protect the interests of buyers and developers alike.

- Accountability: The RERA Act has brought about more accountability and transparency within the real estate industry.

|

S.No. |

Documents required from developers to register an on-going project:

|

Documents required for Agent Registration |

|

|

Copy of PAN and Aadhar of promoter

|

Copy of PAN and Aadhar of the Real Estate Agent

|

|

|

Copy of approval obtained from the competent authority

|

Details of the real estate agent such as name, address, contact details and photographs of individual/ partners/ directors.

|

|

|

Development Plan

|

Copy of the address proof

|

|

|

Project details (location of the project, layout and sanctioned plan of the project)

|

|

|

|

Details of designing standards, construction technology type, resistant measures in case of the uncertain event and amenities/facilities in the layout plan.

|

|

|

|

Income Tax Returns (ITR) and audited financial statements of the past 3 years.

|

|

|

|

Title Deed along with the chain of title |

|

|

|

Documents of ownership such as proforma of the allotment letter, sale agreement, and conveyance deed. |

|

|

|

If the promoter is not the owner then consent detail of the owner along with the collaboration agreement, development agreement, joint development agreement, title deed or any other agreement entered into between the promoter and owner. |

|

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)